indian land tax credit issues:

Federal Property and Employment Tax Benefits for Indian Lands

by

Senate Staff

October, 1997

In the Budget Reconciliation Act of 1993, Congress provided income tax incentives to businesses located on Indian reservations. The way the term "Indian reservations" was used in the bill caused confusion as to Congressional intent. To resolve this issue, Congress further defined "reservations" and portions of Oklahoma that qualify as reservations in the Taxpayer Relief Act of 1997. With this latest action, Congress has made certain its intent for application of these tax incentives in Oklahoma.

- The Omnibus Budget Reconciliation Act of 1993 added two federal income tax incentives designed to stimulate economic development on Indian reservations throughout the United States.

- The accelerated depreciation for property on Indian reservations allowed businesses to depreciate their capital expenses more rapidly than other properties, which could reduce a business's tax liability earlier and in turn improve the present value of its after-tax income.

- The tax credit for Indian employees allowed businesses to use a portion of the wages paid and health insurance benefits provided to Indian employees to directly reduce their tax liability and in turn increase after-tax income. - Due to Oklahoma's unique history, it has a very high Native American population but no current "Indian reservations". The Taxpayer Relief Act of 1997 clarifies the definition of the term "Indian reservation" in Oklahoma as "lands which are within the jurisdictional area of an Oklahoma Indian tribe (as determined by the Secretary of the Interior)".

- To further clarify Congressional intent, Congressman Wes Watkins constructed a "bright-line test" in which the eligible lands are determined to be "lands within boundaries of the last treaties with the Oklahoma tribes".

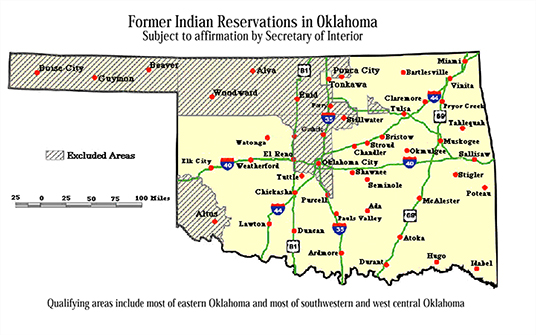

- Currently, approximately two-thirds of Oklahoma qualifies for the depreciation and employment tax credit incentives. The areas that do not qualify are historically identified as No Man's Land, Old Greer County, the Unassigned Lands, and the Cherokee Outlet.

The passage of the Taxpayer Relief Act of 1997 on August 5, clarified the term "Indian reservation" as it pertains to Oklahoma as "lands which are within the jurisdictional area of an Oklahoma Indian tribe". For purposes of Congressional intent, the House Ways and Means Committee defines an Indian reservations in Oklahoma as "lands within boundaries of the last treaties with the Oklahoma tribes." This definition satisfied Committee Chairman Bill Archer in that it narrowed the scope of the qualifying lands by eliminating the Unassigned Lands.

The Internal Revenue Code of 1986 (as amended) now provides for additional accelerated depreciation of property placed on an Indian reservation (as defined above). To be eligible, the property must:

- be used by the taxpayer predominantly in the active conduct of a trade or business within an Indian reservation on a regular basis.

- not be used or located outside the Indian reservation on a regular basis.

- not be used in conducting or housing class I, II or III gaming as defined in the Indian Regulatory Act.

- not be residential rental property.

- not be owned by a person who is required to use the "alternative depreciation system".

The schedule of depreciation for qualifying properties is as follows:

General Depreciation System Lives Code Section 168(j) Lives 5 years 3 years 7 years 4 years 10 years 6 years 15 years 9 years 20 years 12 years 39 years(nonresidential real property) 22 years

The Indian Employment Credit is available for wages paid or incurred to employees on an Indian reservation. It provides for a twenty percent non-refundable income tax credit for wages paid to and health insurance premiums paid for each employee who is an enrolled member of an Indian tribe (or the spouse of an enrolled member).

Only the amount of such wages and health insurance premiums in excess of such costs for the employee in 1993 are eligible for the credit.

The maximum amount of wages and health insurance costs that can be counted in any year is $20,000; therefore, the maximum annual credit per employee is $4,000.

The credit cannot be claimed in the employee's first year of employment if the wages are also counted for the work opportunity credit.

Health insurance costs paid under a salary reduction agreement or "cafeteria plan", cannot be counted.

There are several technical rules that affect eligibility. For example, the credit is not available for employees involved in a gaming business or employees who are owners of at least 5 percent of the business.

Employees who earn over $30,000 in wages are not eligible.

background

In 1992 Senator John McCain, R-Arizona, drafted a tax bill with the assistance of the Navajo Nation to make it more attractive for businesses to hire Native Americans and to invest in reservation land. This bill was ultimately vetoed by President Bush.

The 1993 budget-reconciliation bill included "empowerment zones" aimed at low-income inner cities and poor rural areas. McCain fought to make Indians eligible for the program as well arguing that Indians are among the poorest Americans. Oklahoma Indians were often excluded from these types of assistance packages because they are commonly aimed at Indian "reservations". Oklahoma has no official reservations, because land that was once reservation land has since either been allotted for settlement or given to individuals or tribes. Then Oklahoma Senator David Boren insisted that Oklahoma Indians be included in the tax incentives.

The Omnibus Reconciliation Act of 1993 was signed into law on August 10, 1993. It contained two provisions to stimulate economic development on Indian reservations by providing assistance to companies investing in and conducting business on such lands between the years 1994 and 2003. These tax incentives were similar to those targeted at other areas of economic depression, known as empowerment zones. First, the Act authorized Accelerated Depreciation Values for Property on Indian Reservations and second, it outlined the Indian Employment Credit.

The accelerated depreciation for property on Indian reservations allowed businesses to depreciate their capital expenses more rapidly than other properties, which could reduce a business's tax liability earlier and in turn improve the present value of its after-tax income.

The tax credit for Indian employees allowed businesses to use a portion of the wages paid and health insurance benefits provided to Indian employees to directly reduce their tax liability and in turn increase after-tax income.

It was not clear as to how much of Oklahoma was to be covered by this Act. The definition of "Indian Reservation" was imported by cross reference from the Indian Financing Act of 1974 citing the definition to include "former Indian reservations in Oklahoma". This definition essentially encompassed the entire state of Oklahoma (the Panhandle and "old Greer county" excluded). The Associated Press called the language in the bill a legal "quirk" and other members of Congress have called it a "mistake that is giving tax breaks to big business". In his introduction of the bill, co-author Senator Boren indicated that his motivation for including this definition of the word "reservation" was to protect Oklahoma from exclusion of the Act that could greatly benefit our state's Native Americans. As noted above, the 1997 amendments have clarified the areas of the state in which the incentives apply.

Some members of Congress objected to the interpretation and initiated a move to change the definition of "reservation" to only apply to "Indian lands held in federal trust and not to former reservations".

The IRS suspended action on these issues during 1996, anticipating Congressional modification or repeal of the applications of the provision. Since then, most businesses have adopted a wait-and-see attitude.

THE USE OF TAX BENEFITS

It is anticipated that these tax benefits will be widely used to enhance economic development efforts in Oklahoma. Some area Chambers of Commerce began to use the law as a tool to attract new industry to the state even before the 1997 amendments. The Ardmore Development Authority has presented the law and the interpretation of it to the Oklahoma Governor's Economic Development Team in Tulsa. Also keeping a close eye on the issue is Oklahoma's Department of Commerce. This provision could give cities like Tulsa, Lawton and Enid an advantage over other cities such as Austin, Dallas, Portland and Atlanta. For companies with large capital costs, "that gives you an additional almost $150 million on your bottom line..." states economist Dan Gorin of the Department of Commerce.

Accounting firms from Tulsa to Ardmore advised their clients take full advantage of the law in 1996. Other firms gave their clients the option of filing a special IRS form to provide for the depreciation benefit the client would have received the previous two years had they known about the provision or had the Congressional intent been clear.

Oklahoma Senate

Oklahoma Senate